Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

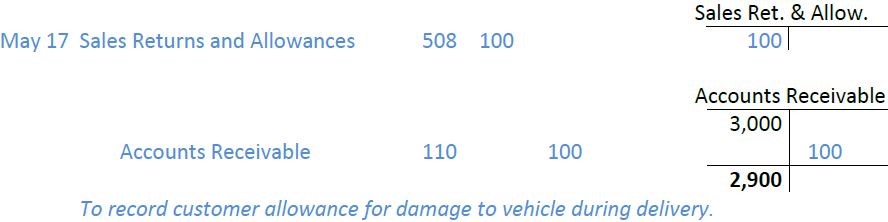

Journal Entries:

- Post an accounting entry for purchase returns in the books of Unreal Corporation.

- You might offer free returns, charge a restocking fee, accept returns only with a receipt, or not accept returns at all.

- We reduce the full amount owed on May 4 less the return of $250.

- The journal entries for the return of merchandise purchased for cash and merchandise purchased on account are different.

Sometimes, the supplier does not offer goods in exchange, or the company does not exchange. This compensation may include cash return or reduction in balance with the supplier. The accounting entries for this transaction will be as follows. Like purchase returns, purchase allowances can also occur due to various reasons. A purchase allowance is a reduction in the price of goods or services after delivery.

Our Services

It is important to distinguish each inventory item type to better track inventory needs. Under the perpetual method, we must always track changes to the cost of inventory. Yes, the cost is now $200 lower than it was previously recorded because of the allowance provided by Whistling Flutes. Therefore, we must record the decrease in the cost of the inventory.

Format of Purchase Returns and Allowances Journal

The purchase returns and allowances journal is a Special Journal used to track these returns and allowances. Entries from the purchase returns and allowances journal are posted to the accounts payable subsidiary ledger and general ledger. When merchandise purchased on account is returned, or when an allowance is requested, an entry is made in the purchase returns and allowances journal.

Trial Balance

The refunds and other allowances given by suppliers on merchandise originally purchased for resale are known as purchase returns and allowances. Merchandise that is returned to suppliers is known as returns outward. To illustrate the periodic inventory method journal entries, assume that Hanlon Food Store made two purchases of merchandise from Smith Company.

On June 1, CBS purchased 300 landline telephones with cash at a cost of $60 each. On June 3, CBS discovers that 25 of the phones are the wrong color and returns the phones to the manufacturer for a full refund. The following entries occur with the purchase and subsequent return. On May 1, CBS purchases 67 tablet computers at a cost of $60 each on credit.

Let us understand the disadvantages of credit or cash purchase return journal entries through the discussion below. Hence, when the goods are returned, the inventory needed to be reduced too. Likewise, in this journal entry, there is no inventory account involved. This is due to, under the periodic system, the company does not record the inventory either when it makes the inventory purchase journal entry. Sometimes the company may receive compensation from the suppliers when something is wrong with the goods and it doesn’t have to return the goods. However, the journal entry for it will be with the same accounts as the purchase return.

The purchase was on credit and the allowance occurred before payment, thus decreasing Accounts Payable. Merchandise Inventory decreases due to the loss in value of the merchandise. Both Accounts Payable decreases (debit) and Merchandise Inventory-Printers what are operating activities in a business decreases (credit) by $1,500 (15 × $100). The purchase was on credit and the return occurred before payment, thus decreasing Accounts Payable. Merchandise Inventory decreases due to the return of the merchandise back to the manufacturer.

In the periodic inventory system, the purchase returns and allowances are recorded into the purchase return and allowances account which is the contra account of the purchases account. Conversely, in the perpetual inventory system, the purchase returns and allowances are recorded as a reduction to the merchandise inventory account directly. When merchandise purchased for cash is returned, it is necessary to make two journal entries. The first entry debits the accounts receivable account and credits the purchase returns and allowances account. The second entry debits the cash account and credits the accounts receivable account. When merchandise purchased on account is returned, only one entry is necessary, which debits the accounts payable account and credits the purchase returns and allowances account.

Commentaires récents